1 4 · d e t e k t o r i n t e r n a t i o n a l

Security News Every Day

www. securityworldhotel.com

security

technology market

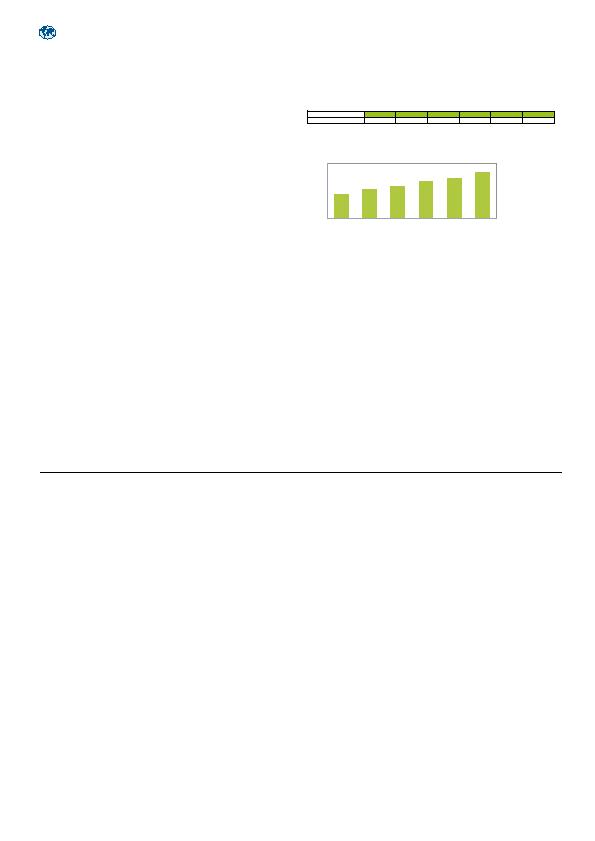

Videosurveillanceharddrivemarkettohit$1billion

El Segundo, Ca (USA)

Revenue for both internal and ex-

ternal HDDs in video-surveillance

applications will rise from $638.7

million this year to $1.0 billion

by 2017, a remarkable 57 percent

increase. Growth this year alone is

forecast to reach 23 percent from

2012 revenue of $521.1 mil-

lion, and double-digit-percentage

revenue expansion will ensue each

year for the next four years, as

shown in the attached figure.

The revenue figures translate to

7.3 million units in shipments by

2017, up from 2.4 million units in

2012 and a projected 3.5 million

units this year.

"The HDD industry as a

whole will reap the benefits of a

fast-growing video surveillance

industry that requires ample

storage, with the need for higher-

quality video, network connectiv-

ity and cloud storage also driving

the market," said Fang Zhang,

analyst for storage systems at IHS.

"At present, internal HDDs that

combine storage capacity with

the recording system in one unit

have a larger market than external

HDDs in which the drive is

separate. Shipments of HDDs for

internal storage were higher than

those for HDDs in external stor-

age during 2012 a feat that will

be replicated this year."

Products on the market today

that use internal HDDs for video

surveillance include internal direct

attached storage (DAS), enterprise

digital video recording (DVR), box

appliance network video recorder

(NVR) and PC-based network

video recorders.

Next year, however, the tables

get turned permanently as external

storage HDD shipments take the

lead. From a 48 percent share of the

market in shipments last year of the

total HDD space for video surveil-

lance, external HDDs leap over in-

ternal HDDs in 2014 with a slight

majority of 51 percent share of the

market. And while internal HDDs

continue to retain a viable portion

of the market, external HDDs will

keep gaining in the market with

their share hitting approximately 54

percent by 2017.

While internal storage is a

cost-effective way of storing video

data, external storage boasts larger

capacities that can be added flex-

ibly to a system as the need arises.

External storage also has more

versatile applications as it can be

connected or viewed anywhere,

such as in the cloud, where the

potential for external storage

is plentiful and abundant. The

capability of external systems

to scale and accommodate large

amounts of video data is one

reason why more hard disk drives

will be needed in the coming

years, pushing both shipments and

revenues up. Another reason is

that high-quality video itself will

demand more storage space, which

also will help boost HDD use in

video surveillance.

All told, IHS believes that total

HDD shipments for video surveil-

lance will grow at a compound

annual growth rate of 29 percent

from 2012 to 2017, with revenue

likewise increasing at a lower but

still-solid rate of 14 percent.

Worldwide Forecast of Video Surveillance HDD Revenue (Millions of US Dollars)

2012

2013

2014

2015

2016

2017

Millions of Units

521,1

638,7

702,1

798,0

879,2

1 005,1

Source: IHS Inc., June 2013

Source: IHS Inc., June 2013

0,0

200,0

400,0

600,0

800,0

1000,0

1200,0

2012

2013

2014

2015

2016

2017

Worldwide Forecast of Video Surveillance HDD Revenue

(Millions of US Dollars)

The market for hard disk drives (HDDs) used in video

surveillance will hit the billion-dollar level in less than

five years, as safety concerns and the requirement for

higher image quality spur demand for more data stor-

age, according to a Storage Space Market Brief from

information and analytics provider IHS.

Worldwide, revenue for electronic

security equipment in city security

will expand at a compound annual

growth rate of 17.8 percent from

2012 to 2017. By 2017, wireless

infrastructure and CCTV and

video surveillance equipment will

amount to just over $3.2 billion,

up from $1.4 billion in 2012.

City surveillance is a key tool

for police departments to manage

metropolitan centre locations,

with crime reduction typically

being the main goal. Using this

technology, police can access video

surveillance feeds from mobile

command centres when respond-

ing to an incident. This allows

the police to coordinate efficient,

quick responses to any event.

Several threats

Cities face a number of threats,

ranging from the kind of wide-

spread civil unrest that recently

affected Istanbul to lone-wolf and

terrorist attacks, like the recent

Boston marathon bombings.

These threats underscore the need

to provide fast access for video

surveillance systems.

"City video surveillance

systems have a key requirement

to provide clear, useable images so

that police departments can con-

duct effective investigations when

needed," said Paul Bremner,

market analyst for Safe Cities

and Security Services at IHS.

"If the video surveillance system

can't do that, then it is failing in

its primary purpose."

Video streams

Along with fast access for video

surveillance systems, the re-

quirement to push video streams

out to various individuals and

organisations across the city has

increased. The mobility offered

by these video systems is a key

tool for police departments

when managing city-centre

locations.

"For cities the focus has

shifted from basic surveillance

needs toward mobile surveil-

lance," Bremner continued.

"Emerging technology can send

the video to police officers on

the street, streaming that video

directly to the smartphones or

laptops in their patrol cars. Such

mobile surveillance technology

will act as a force multiplier for

the officers on the ground."

The IHS report entitled

"Vertical Insights Video

Surveillance and Security in City

Surveillance World 2013

Edition" combines feedback

from end users, integrators and

consultants working within

the city surveillance market.

The report explores the threats

faced by cities, critical success

factors for security systems and

the decision processes behind

city surveillance projects. The

report presents market sizes and

forecasts to 2017 for EMEA,

Asia and the Americas. It is part

of a series of reports focused on

six different end-user industries

including banking and finance,

city surveillance, critical infra-

structure, education, retail and

transportation.

The global market for electronic security equipment

aimed at city surveillance applications will more than

double in size from 2012 to 2017 as metropolitan

areas adopt mobile technology to deal with threats

more efficiently. This is according to a new report

from IHS.

Citysurveillancemarkettomorethandoubleby2017