The global physical security market is projected to

grow from 120.79 billion US dollars in 2025 to 151.50 bil-

lion US dollars by 2030, at a CAGR of 4.6 per cent dur-

ing the forecast period, according to the latest findings

from research company, Marketsandmarkets.

The rise in security breaches

and malicious attacks in areas

like transportation, healthcare,

government, and commercial

buildings is increasing the need

for stronger physical security.

Organisations are now focusing

on real-time protection, from

controlling access to preventing

threats across their facilities, ac-

cording to the report.

Investing in modern

solutions

The threat landscape is becom-

ing more complex, with attackers

using a combination of physical

intrusions and cyber techniques,

along with insider threats,

unauthorised drone activity, and

coordinated break-ins at sensi-

tive locations like hospitals and

airports. To address these risks,

businesses are investing in modern

solutions such as integrated access

control systems, smart sensors,

and AI-powered surveillance that

enhance safety without disrupting

operations, Marketsandmarkets

stresses.

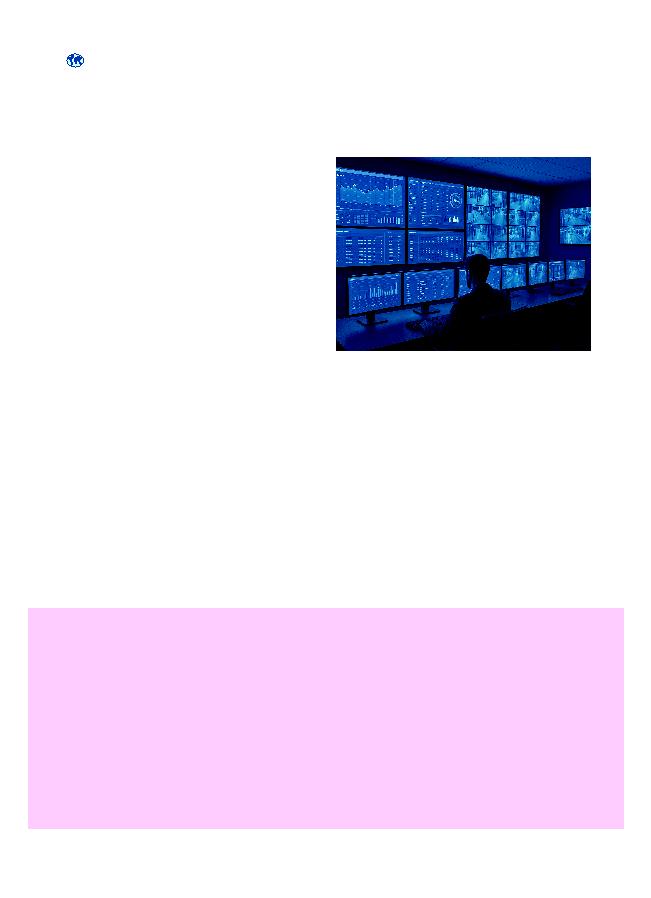

Video surveillance still

takes the major share

Expanding needs for real-time

monitoring, crime prevention,

and upgrading public safety across

commercial, government, and

infrastructure sectors are driving

demand for video surveillance

systems. IP cameras and video ana-

lytics now provide functionality

much more advanced than mere

recording, like providing action-

able insight in the form of motion

detection, face recognition, and

behavioural analysis.

Integrated into smart infra-

structure, these solutions provide

real-time awareness of vehicles,

machinery, and building perim-

eters. With increasing security

threats and operational intelli-

gence moving to the centre stage,

deployment is increasingly taking

place in high-risk locations such

as banks, malls, transportation

centres, and public spaces.

Despite advancements in smart

and data-driven technologies,

video surveillance still remains

a vital component in preventing

security incidents and enhanc-

ing proactive threat management

across sectors.

Deterrence, detection and

rapid response capabilities

With expansive assets and complex

infrastructure, large-sized business-

es are more vulnerable to physical

attacks, driving their strong reli-

ance on advancing their physical

security systems. To address these

vulnerabilities, such as unauthor-

ised access to data centres, insider

threats, theft of valuable equip-

ment, tampering with operational

systems, or targeted attacks on

executive facilities, large enter-

prises demand integrated physical

security frameworks that combine

deterrence, detection, and rapid

response capabilities.

AI, IoT, and real-time

analytics

Large enterprises typically allocate

high budgets for security, enabling

them to deploy integrated solu-

tions powered by AI, IoT, and real-

time analytics. Moreover, the need

to meet regulatory requirements

and protect brand reputation

further drives their investment in

robust, enterprise-grade physical

security systems, according to the

report.

Global physical security market to

surpass 150 billion dollars by 2030

Expanding needs for real-time monitoring, crime prevention, and upgrading public safety

across commercial, government, and infrastructure sectors are driving demand for video

surveillance systems.

Delray Beach, Fl (USA)

Security News Every Day

www.securityworldmarket.com

6 · d e t e k t o r i n t e r n a t i o n a l

Security Technology

Market

Newport Pagnell, Buckinghamshire (UK)

The transition to cloud technology and the rise of artifi-

cial intelligence in video surveillance are the two main

macro trends identified in the "World Market for Video

Surveillance Hardware and Software 2025 Edition"

report from Novaira Insights.

The US and Canadian markets are

leading the shift towards cloud-

based solutions, with significant

growth in recurring cloud video

management software revenues.

Better video analytics

performance

Additionally, AI technologies

are enhancing video analyt-

ics performance, approaching a

majority of new camera shipments

to include deep learning powered

video analytics capabilities on

their embedded chipsets. This

plus the renewed drive towards

system wide intelligent automa-

tion is propagating AI use across

surveillance systems, according to

the report.

High growth in

emerging markets

The report forecasts a compound

annual growth rate (CAGR) of

8.1 per cent for the global market

excluding China from 2024 to

2029. This growth is driven by

robust expansion in emerging

markets such as India, Latin

America, and the Middle East,

along with increased demand for

cloud solutions in established

markets like North America and

Western Europe. Novaira Insights

estimated the global market for

video surveillance equipment to

be worth 25 billion dollars in

2024.

The biggest video trends: AI and cloud technology