The Global Video Surveillance Business 2025 to 2030

Cameras, storage, software & analytics market analysis

This comprehensive study examines the current and anticipated landscape of the global video surveillance market through to 2030. Drawing on expertise in our previous Internet of Things, Artificial Intelligence, and Cybersecurity analysis, this report empowers professionals across the industry, from manufacturers to system integrators, from security consultants to facility managers and building owners.

It is the first installment of a two-part series covering Physical Security Technology. Part 2, covering Access Control Systems, will be published in Q4 2025.

Key questions addressed

- What is the size and structure of the global video surveillance market in 2025? How is the market divided between cameras, storage, software, and analytics? Where are the dominant geographic markets? How are sales distributed across 12 different industry verticals?

- How are AI and edge computing transforming the industry? What percentage of cameras now ship with built-in AI capabilities? Which applications are driving adoption? How are vendors balancing edge processing with cloud analytics?

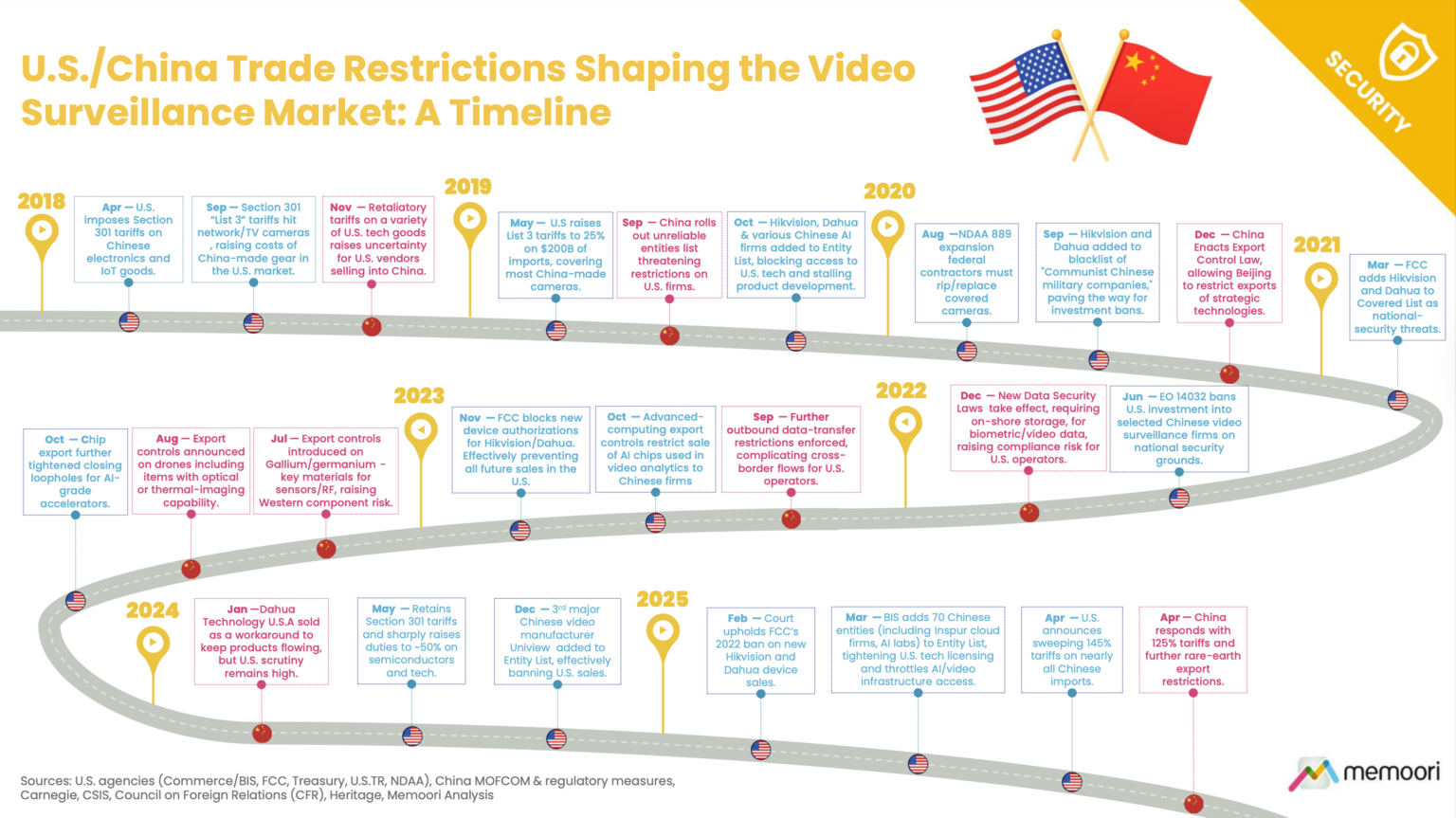

- What impact are geopolitical tensions having on market dynamics? How have US-China trade restrictions, NDAA compliance requirements, and supply chain restructuring reshaped competitive positioning? Which vendors are gaining or losing market share as a result?

- How are M&A, investment, and strategic alliances evolving? Which technology areas are attracting capital? How are private equity and strategic buyers reshaping market structure? What does the alliance landscape reveal about platform consolidation versus ecosystem flexibility?

Within its 246 Pages and 18 Charts, This Report Presents All the Key Facts and Draws Conclusions, so you can understand what is Shaping the Future of the Video Surveillance Industry:

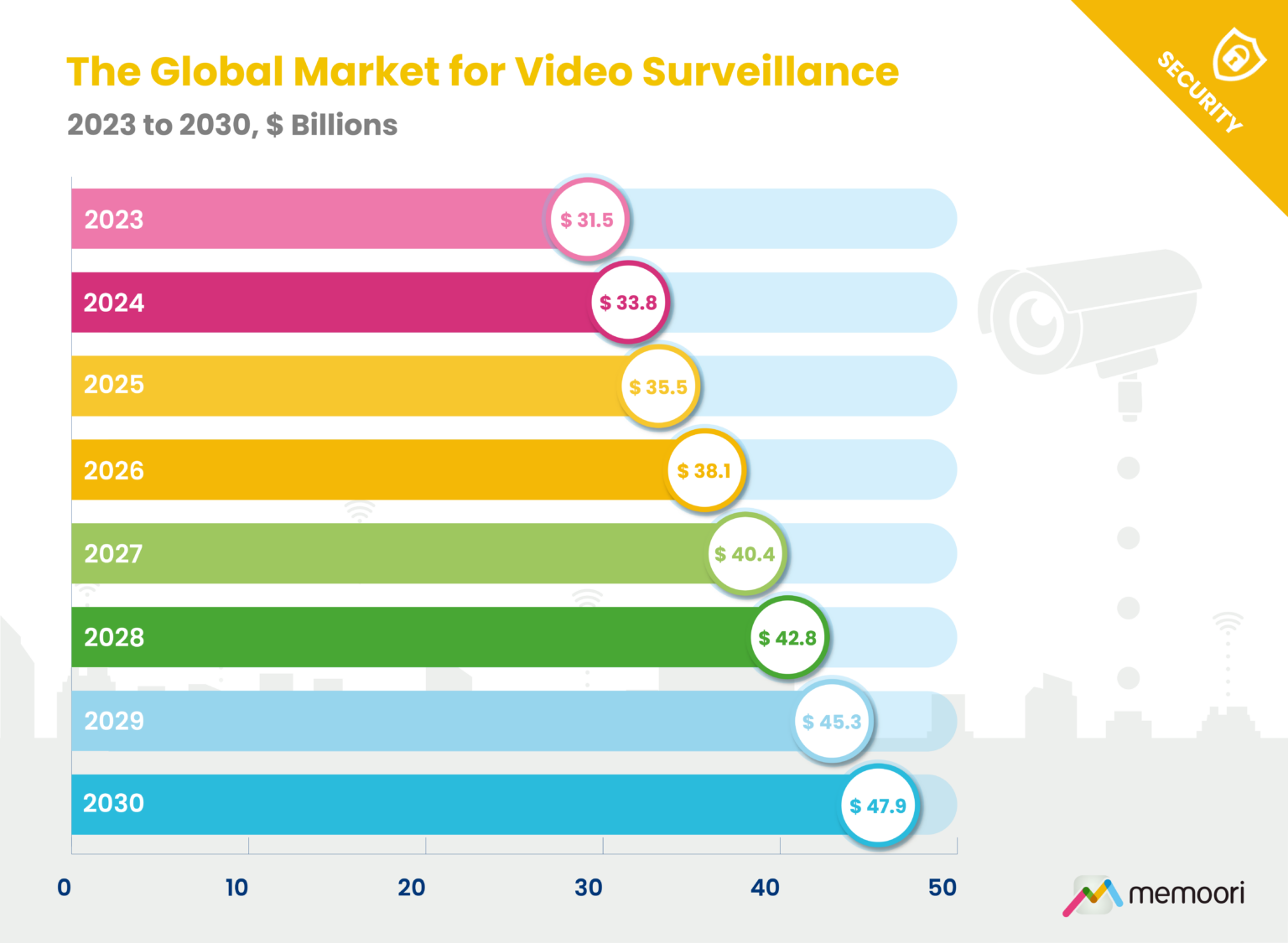

- Total global revenues for video surveillance equipment and software at factory gate prices reached $33.8 billion in 2024, with projections of $35.5 billion in 2025 and growth to $47.9 billion by 2030. This represents a compound annual growth rate of nearly 6%, reflecting the sector’s transition from reactive security deployments to strategic, intelligence-driven infrastructure investments.

- Our market analysis encompasses 4 core segments: video camera hardware, software and analytics, video storage, and supporting hardware infrastructure. This breakdown reveals an industry increasingly defined by software capabilities and recurring revenue models, with analytics and cloud services growing at more than twice the rate of traditional equipment sales.

- AI-enabled cameras capable of edge processing are projected to account for a significant percentage of global camera shipments in 2025. These systems deliver capabilities ranging from object detection and license plate recognition to behavior analysis and privacy-preserving redaction, fundamentally transforming video surveillance from passive recording to active operational intelligence.

- Drones are emerging as a significant expansion vector for video surveillance capabilities. Drones extend surveillance coverage to areas impractical for fixed cameras, provide rapid-deploy capability for incident response, and enable persistent wide-area monitoring for critical infrastructure, large campuses, and border security applications. The integration of drones with ground-based systems and real-time crime centers represents a fundamental expansion of surveillance architecture from static observation points to dynamic, mobile sensor networks.

At only USD $3,000 for an enterprise license, this report provides essential intelligence for strategic planning, competitive positioning, M&A evaluation, and technology roadmap development.

Geopolitical Tensions Continue to Reshape Market Access and Competitive Dynamics

Geopolitical tensions between China and the West have bifurcated the market, with Chinese vendors facing US procurement bans, FCC equipment authorization restrictions, and expanding export controls. These restrictions have created sustained opportunities for NDAA-compliant alternatives that position regulatory alignment and cybersecurity transparency as core brand values.

Between September 2023 and August 2025, 24 M&A transactions were observed. Investment activity totaled $3.8 billion across 38 deals during the same time period. Key trends include platform consolidation integrating hardware, software, and cloud services; private equity actively reshaping market structure; strategic focus shifting from hardware toward software and recurring revenue; and AI integration driving acquisitions of computer vision and privacy-preserving startup firms.

Who should buy this report?

This report delivers critical intelligence for:

- Security manufacturers and vendors developing product roadmaps, positioning strategies, and go-to-market plans.

- System integrators and service providers evaluating technology partnerships, training investments, and service offerings.

- Private equity and strategic investors assessing M&A targets, market positioning, and competitive dynamics.

- Building owners, facility managers, and corporate security leaders planning capital investments and technology refresh cycles.

- Consultants and advisors supporting clients across procurement, compliance, and strategic planning.

Table of Contents

- Preface

- Executive Summary

- 1. The Structure & Shape of the Video Surveillance Business

- 1.1 Video Surveillance Market Structure

- 1.2 Company Classifications & Market Share

- Group A Companies

- Group B Companies

- Group C Companies

- Group D Companies

- 1.3 Sales & Distribution Channels

- 2. The Video Surveillance Market

- 2.1 Video Surveillance Adoption & Investment

- 2.1.1 Market Operation Conditions

- 2.1.2 Key Adoption Drivers

- 2.1.3 Physical Security Spending Plans & Budgets

- 2.2 Video Surveillance Market Size & Growth Forecasts

- 2.2.1 Overall Market Projections and Trajectory

- 2.2.2 Market Forecast Breakdown by Category

- 2.3 Market Size, Growth & Trends by Major Region

- 2.3.1 North America

- 2.3.2 Latin America & The Caribbean

- 2.3.3 China

- 2.3.4 The Rest of Asia Pacific

- 2.3.5 Europe

- 2.3.6 Middle East & Africa

- 2.4 Market Size & Trends by Vertical

- 2.4.1 Public Infrastructure & City Surveillance

- 2.4.2 Offices

- 2.4.3 Retail

- 2.4.4 Transport

- 2.4.5 Healthcare

- 2.4.6 Education

- 2.4.7 Manufacturing & Logistics

- 2.4.8 Hospitality

- 2.4.9 Data Centers

- 2.5 Video Cameras

- 2.6 Video Surveillance Cameras

- 2.6.1 Market Dynamics

- 2.6.2 IP vs Analog

- 2.6.3 Camera Form Factors

- 2.6.4 Key Players & Vendor Landscape

- 2.7 Body Worn Cameras

- 2.7.1 Market Size & Growth Trends

- 2.7.2 Market Dynamics

- 2.7.3 Key Players & Vendor Landscape

- 2.8 Thermal Cameras

- 2.8.1 Market Size & Growth Trends

- 2.8.2 Market Dynamics

- 2.8.3 Key Players & Vendor Landscape

- 2.9 Video Surveillance Software & Analytics

- 2.9.1 Market Size & Growth Trends

- 2.9.2 Market Dynamics

- 2.9.3 Key Players & Vendor Landscape

- 2.10 VSaaS & Cloud

- 2.10.1 Market Dynamics

- 2.10.2 VSaaS Business Models and Competitive Landscape

- 2.10.3 Technology and Operational Insights

- 2.10.4 Cost and Regulatory Factors

- 2.11 Video Storage Hardware & Services

- 2.11.1 Market Size & Growth Trends

- 2.11.2 Market Dynamics

- 2.11.3 Key Players & Vendor Landscape

- 2.12 Drones for Video Surveillance

- 2.12.1 Market Size & Growth Trends

- 2.12.2 Market Dynamics

- 2.12.3 Key Players & Vendor Landscape

- 2.1 Video Surveillance Adoption & Investment

- 3. IP Connectivity & the IoT

- 3.1 The Convergence of IP and IoT

- 3.2 The Benefits of IoT-Enabled Video Surveillance

- 3.3 IoT Growth & Adoption Trends

- 3.4 Challenges Associated with IoT adoption

- 4. AI & Machine Learning

- 4.1 Market Adoption & Growth Outlook

- 4.2 Applications and Use Cases

- 4.2.1 Security & Safety

- 4.2.2 Identity & Access Management

- 4.2.3 ALPR/ANPR & Mobility

- 4.2.4 Operational & Business Insight

- 4.2.5 Investigations & Natural-Language Search (NLS)

- 4.3 Edge Devices & Hardware Enablers

- 4.3.1 AI Chips

- 4.3.2 AI Network Video Recorders (NVRs)

- 4.3.3 AI Cameras

- 4.4 Challenges Associated with AI in Video Surveillance

- 4.5 Vendor Landscape

- 4.6 Emerging Trends & Future Outlook

- 5. Wireless & Cellular Technology

- 5.1 Wireless Transmission Methods

- 5.1.1 4G

- 5.1.2 WiFi

- 5.1.3 5G

- 5.1.4 Private LTE/5G Networks

- 5.2 Key Benefits & Use Cases

- 5.3 Challenges & Considerations for Wireless

- 5.4 Wireless & 5G Cameras

- 5.4.1 Wireless

- 5.4.2 5G

- 5.1 Wireless Transmission Methods

- 6. Other Notable Technology Drivers

- 6.1 Image Quality/Resolution

- 6.1.1 Market Adoption and Evolution

- 6.1.2 Application-Specific Resolution Requirements

- 6.1.3 Technical Considerations

- 6.2 Low Light / Infra-Red / Night Vision

- 6.2.1 Enhanced Visible-Light Imaging

- 6.2.2 Integrated Infrared Illumination

- 6.2.3 Specialist Imaging and Non-Visual Sensing

- 6.3 Multi-sensor Devices

- 6.3.1 Market Adoption and Evolution

- 6.3.2 Technical Considerations

- 6.4 Advanced Threat Detection Systems

- 6.4.1 Capabilities and Categories

- 6.4.2 Market Drivers and Adoption Dynamics

- 6.4.3 Notable Vendors & Market Offerings

- 6.5 Integration & Interoperability

- 6.5.1 Benefits of Interoperability

- 6.5.2 The Evolution Toward Open Platforms

- 6.5.3 ONVIF Standards

- 6.5.4 Integration Between Video Surveillance, Physical Security, and Building Systems

- 6.1 Image Quality/Resolution

- 7. Geopolitical Tensions & Trade Barriers

- 7.1 US/China Dynamics

- 7.2 Trade Restrictions in Other Countries and Regions

- 7.3 The War in Ukraine

- 7.4 Market Implications & Impacts

- 7.4.1 Competitive Landscape and Regional Market Realignment

- 7.4.2 Supply Chain Restructuring and Manufacturing Geography

- 7.4.3 Procurement Trends and Buyer Behavior

- 7.4.4 Pricing Dynamics and Cost Structures

- 7.4.5 Product Strategy and Technology Roadmaps

- 7.5 Outlook to 2030

- 8. Supply Chain Trends

- 8.1 Current Supply Chain Conditions

- 8.2 Strategic Shifts in Sourcing and Manufacturing

- 8.3 Supply Chain Outlook to 2030

- 9. Skills, Talent & Labor

- 9.1 Key Challenges

- 9.2 Emerging Opportunities

- 10. Cybersecurity

- 10.1 Key Threats and Vulnerabilities

- 10.1.1 Attack Vectors

- 10.1.2 Supply Chain and Integration Risks

- 10.1.3 Threat Landscape

- 10.2 Cybersecurity Incidents & Vulnerabilities

- 10.3 Regulations and Compliance

- 10.4 Breach and Vulnerability Disclosure

- 10.5 Mitigation Best Practices

- 10.1 Key Threats and Vulnerabilities

- 11. Data Privacy & Ethics

- 11.1 Privacy Considerations

- 11.2 Privacy Regulations

- 11.3 Facial Recognition: Legal and Operational Constraints

- 11.4 Ethical Implementation and AI Bias

- 12. Mergers & Acquisitions

- 12.1 Historic M&A Market Dynamics

- 12.2 New M&A Deals (Sept 2023 to Aug 2025)

- 12.3 M&A Trends and Implications

- 13. Strategic Alliances

- 13.1 Historic Strategic Alliances & Market Dynamics

- 13.2 New Strategic Alliances (Sept 2023 to Aug 2025)

- 13.3 Strategic Alliance Trends and Implications

- 14. Investment Trends

- 14.1 Historic Investment Deals & Investment Market Dynamics

- 14.2 New Investment Deals (September 2023 – August 2025)

- 14.3 Investment Trend Observations & Implications

List of Charts and Figures

- Fig 1.1 Video Surveillance Market Structure

- Fig 1.2 Market Share of Global Video Surveillance Sales by Major Vendor 2024

- Fig 1.3 Video Surveillance Sales by Major Grouping, Number of Companies, % of Global Sales in 2024

- Fig 2.1 The Security Market Index (SMI) – Index Value & Overall Rating of Current Business Conditions

- Fig 2.2 The Global Market for Video Surveillance 2023 to 2030, $ Billions

- Fig 2.3 The Global Market for Video Surveillance by Category 2021 to 2030, $ Billions

- Fig 2.4 Video Surveillance Sales by Region in 2024, % of Total Video Surveillance Sales

- Fig 2.5 Video Surveillance Sales by Region 2021 to 2030, $Bn

- Fig 2.6 Video Surveillance Sales by Building Type in 2024, $Bn

- Fig 2.7 Global Sales of Video Surveillance Cameras by Type

- Fig 2.8 Global Video Surveillance Camera Market, Analog & IP Camera Market Share, 2021 to 2030, % of Total

- Fig 2.9 Global Video Surveillance Camera Shipments by Form Factor, 2024 % of Total Shipments

- Fig 2.10 Global Sales of Video Management Software (VMS) & Analytics

- Fig 2.11 Global Sales of Video Storage Hardware & Services 2021 to 2030, $Bn

- Fig 2.12 Global Sales of Drones for Video Surveillance 2024 to 2030 $Bn

- Fig 4.1 Global AI Video Surveillance Camera Shipments, % of Overall Video Surveillance Camera Shipments 2024 to 2030

- Fig 4.2 AI for Security and Access Control in Commercial Buildings, Number of Companies Serving Individual Use Cases

- Fig 7.1 – US / China Trade Restrictions Shaping the Video Surveillance Market: A Timeline

Charts & Tables: 18

Released: Q3 2025

Price:

USD 3,000 / Enterprise License *

* Enterprise License is a company-

wide license. Anyone within the company can view the document.